Fossil Fuel Investment Report

Released July 09, 2024

Updated August 09, 2024

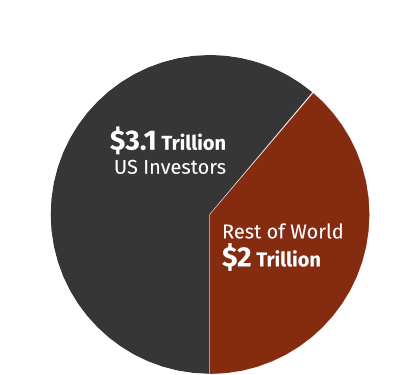

This report reveals the fossil fuel holdings of over 7,500 pension funds, insurance companies, asset managers, hedge funds, sovereign wealth funds, endowment funds and asset management arms of commercial banks. In May 2024, these institutional investors held $5.1 trillion in bonds and shares of fossil fuel companies.

Please be advised that we have added additional investments since the initial publication of the data in July. For some companies and investors, the numbers in the data search tool are thus higher than those in the original media briefing.

For the second year in a row, Vanguard holds the sad record as the world’s biggest fossil fuel investor. The US asset management company holds and manages assets of coal, oil and gas companies worth $444 billion. Due to its sheer volume and because it does not have any fossil fuel policy, Vanguard is the number one in fossil fuel investments worldwide. BlackRock, the world’s biggest asset management company, holds rank number 2. Its fossil fuels assets add up to $431 billion.

Saudi Arabia's Public Investment Fund holds fossil fuel assets worth $367 billion and is on rank 3. Fossil fuel investors number 4 and 5 are State Street, which holds $184 billion, closely followed by Capital Group, which holds $174 billion. Collectively these five asset managers hold and manage assets in fossil fuel companies worth $1.6 trillion.

The US is clearly the elephant in the room here. US institutional investors collectively hold $3.1 trillion in fossil fuel companies in 62 countries and account for 72% of total institutional investments in fossil fuel companies. “This mirrors the complete lack of action by US regulators to effectively monitor and address the climate and transition risks of large institutional investors. This inaction lays the ground for the next economic crisis and puts the world on a fast track towards climate chaos,” says Alec Connon from Stop the Money Pipeline.

The biggest beneficiaries of US institutional investments are domestic oil and gas companies such as ExxonMobil, Chevron, and ConocoPhillips. Institutional US investments in ExxonMobil alone add up to $288 billion or 9% of total US investments in fossil fuel companies. Accordingly, ExxonMobil’s top 5 institutional investors are Vanguard ($53 billion), BlackRock ($37 billion), State Street ($26 billion), Fidelity Investments ($17 billion), and JPMorgan Chase ($11 billion).

Institutional investors from Canada hold 9% of global institutional fossil fuel investments. They collectively invest $265 billion in fossil fuel companies in 53 countries. The biggest Canadian investors are the Royal Bank of Canada and its asset manager RBC Global Asset Management ($45 billion), Sun Life Financial ($34 billion), Power Corporation of Canada ($25 billion), and Toronto-Dominion Bank ($21 billion).

Two of the biggest fossil fuel investments of Canadian institutional investors are in the Canadian oil and gas companies Enbridge ($26 billion) and Canadian Natural Resources Ltd ($20 billion). Canadian Natural Resources Ltd is the world’s largest producer of oil from tar sands and Enbridge is the largest transporter of tar sands oil from Canada’s Alberta province. Alberta's tar sands oil extraction is one of the dirtiest projects on earth.

Japanese institutional investors hold $192 billion in bonds and shares of coal, oil, and gas companies from 49 countries. Out of this total, 53% or $102 billion is invested in fossil fuel companies headquartered in Japan.

Japan’s biggest institutional fossil fuel investor is its Government Pension Investment Fund, which is the world’s largest public pension fund. The pension fund currently holds $58 billion in bonds and shares of fossil fuel companies.

Yuki Tanabe from the Japanese NGO JACSES comments:

"Japan’s institutional investors are lagging far behind many of their international counterparts such as ABP in the Netherlands, the New York State Pension Fund or the asset manager Ostrum in France. 9 years after the Paris Agreement was signed, only one Japanese insurer, SOMPO, has adopted an exclusion policy for coal companies. Japanese investment managers need to realize that there are no secure pensions and investments in a world with a destabilized climate.”

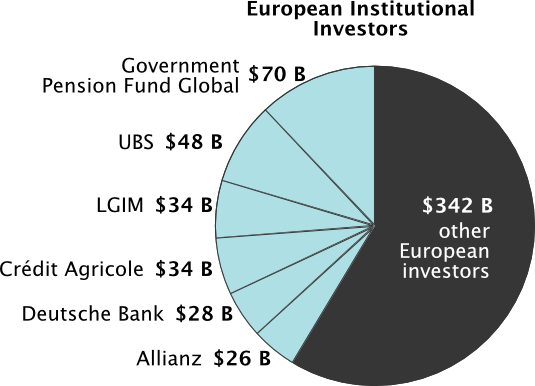

European institutional investors collectively hold $582 billion in stocks and bonds of fossil fuel companies and account for almost 19% of total institutional investments in fossil fuels. Europe’s largest fossil fuel investor is the Norwegian Government Pension Fund Global with investments of over $70 billion in companies listed on GCEL and GOGEL. Dina Rui from the Nordic Center for Sustainable Finance of ActionAid Denmark comments:

"We need to stop using the Norwegian peoples' joint piggy bank to back the fossil fuel companies driving the climate crisis. Not only does fossil fuel investment have a human cost, but it also carries an immense economic risk. Even the leader of IEA has warned investors that betting on fossil fuels is a risky choice. We urgently need our politicians to improve the fund’s climate policies and make a plan for phasing out fossil fuels, starting with coal."

Europe’s second-largest institutional fossil fuel investor is the Swiss bank UBS ($48 billion), followed by LGIM from the UK ($34 billion), France’s Crédit Agricole and its asset manager Amundi ($34 billion), Germany’s Deutsche Bank with its asset manager DWS ($28 billion) and the German insurer Allianz ($26 billion). While Allianz has adopted a strong coal exclusion policy and taken first steps on oil and gas, these policies do not apply to its US-based asset manager PIMCO, which manages the largest share of Allianz's fossil fuel investments.

2024 is the year of climate finance. It was the number one topic at the UN climate meeting in Bonn in June, and it remains the biggest lift at COP29 in Baku this December. But climate finance remains a trickle in comparison to the tidal wave of trillions institutional investors could channel to the fossil fuel industry over the coming years.

2024 needs to become the turning point, the year where central banks and regulators finally act on Article 2.1(c) of the Paris Agreement and take measures to ensure that financial flows are in line with Paris instead of pitted against it. Institutional investors need to start shifting the trillions to supercharge the energy transition and not fossil fuel expansion.